Positive Reaction to HD Earnings

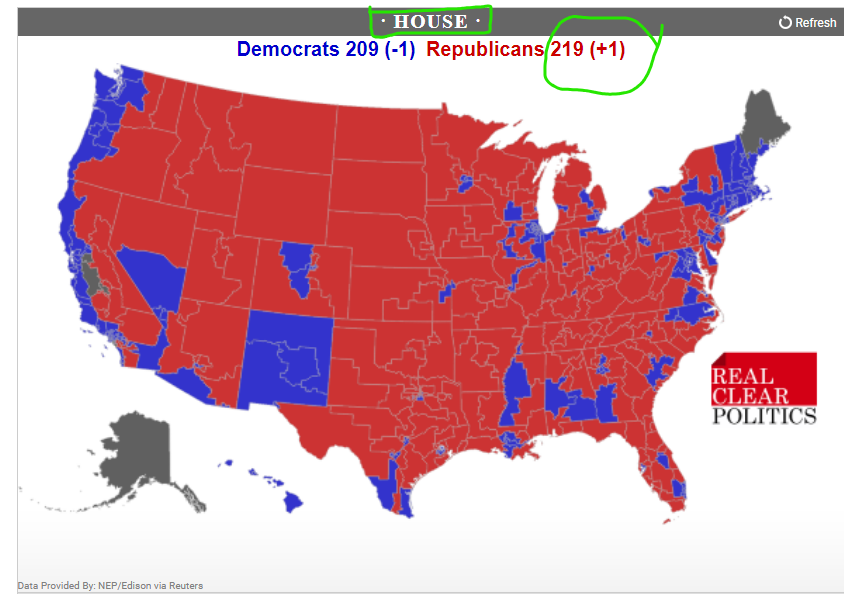

Good Tuesday Morning, MPTraders! November 12, 2024-- Pre-Market Update: Republican Trifecta: A Republican majority sweep: Senate, House, and POTUS (and add into the sweep, a Conservative-leaning SCOTUS)... Let's hope Trump et al, use this mandate wisely to benefit all Americans, and just maybe, we will be on our way to becoming a post-partisan nation for the first time in 30 years, where our elected leaders, Republicans and Democrats alike, work FOR THE PEOPLE (wouldn't that be nice!)... (continued below the map)...

Home Depot reported strong earnings this AM. According to Seeking Alpha:

Home Depot (NYSE:HD) reported revenue rose 6.6% year-over-year to $40.2 billion in Q3. Comparable sales in the U.S. decreased 1.2% for the quarter that ended on October 27 to beat the consensus expectation for a drop of 3.3%. Customer transactions were down 0.2% year-over-year to 399 million. Average ticket fell 0.8% to $88.65. Sales per retail square foot was down 2.1%...

"While macroeconomic uncertainty remains, our third quarter performance exceeded our expectations," stated CEO Ted Decker. "As weather normalized, we saw better engagement across seasonal goods and certain outdoor projects as well as incremental sales related to hurricane demand," he added. In general, home improvement retailers such as Home Depot (HD) have been dealing with homeowners putting off bigger projects due to higher rates and lingering concerns about inflation.

Technically, my attached BIG Picture Daily Chart setup shows this morning's positive reaction to Earnings, which popped the stock to a pre-open high at 420 versus yesterday's 408.29 close (+2.9% at this morning's spike-high) amid a massive Cup and Handle accumulation/bottom formation that still has unfinished business on the upside and projects into the 445-450 Target Zone.

As long as any forthcoming bout of weakness is contained above 405.30 as a worst-case near-term pullback scenario, weakness above 405.30 should be considered buying opportunities for anyone looking for a big-cap cyclical name that should benefit from the Fed's rate cut cycle and Trump's pro-growth, reduced regulatory, and lower tax agenda... Last is 415.02 (continued below the HD Chart)...

As for ES, if today's early weakness is supposed to be a sign of a "Turnaround Tuesday" session, then it sure is starting off as a feeble one. ES is down all of 5 points, and remains just 0.5% from yesterday's ATH at 6053.25. The form of the pullback from the ATH to the overnight low at 6012.25 exhibits corrective form so far, which is a "warning signal" that there is more upside ahead after this brief, shallow digestion period runs its course.

As long as any additional weakness is contained above or within the 5960-5990 worst-case downside support window (see my attached Hourly Chart), ES will remains poised to enter another upleg within the post-election, post-11/04/24 upleg that projects next to 6090-6110... Last is 6030.50, now down just 1.25 points...