Markets React To Tariff News

Good Monday Morning, MPTraders! December 6, 2025-- Pre-Market Update: At 6 AM ET, The Washington Post uploaded a story entitled, "Trump Aids Ready "Universal" Tarif Plans-- With One Key Change... President-elect's aides look at universal duties, but only on certain sectors, among the first big moves of his presidency."

Immediately after the story was posted (https://www.washingtonpost.com/business/2025/01/06/trump-tariff-economy-trade/) the Dollar Index nosedived 0.8%, and the stock index futures (ES) spiked higher by 0.7%. My attached Big Picture Daily Chart of DXY shows the downside reversal is occurring right in my optimal technical target zone from 108.30 to 109.80, designated as the area where DXY is highly vulnerable to the completion of the entire 9.4% September-January upleg. If this knee-jerk downside reaction in the Dollar has shelf-life, then downside continuation that breaks and sustains beneath initial consequential support at 107.60/80 will confirm a major trend reversal for the greenback, which will have ripple effects in the precious metals (higher) and commodity sectors (higher). As we speak, SLV +1.8%, GLD +0.2%, Crude +0.6%, and Nat Gas +8% (aided by the Polar Vortex winter storm gripping the mid-section of the US)... (continued below my DXY Chart)...

As for ES, this AM's knee-jerk vertical upside pop at 6 AM ET ripped above last week's key nearest resistance level at 5995/75 (see my attached Hourly chart) to a new rally high at 6034.50 off of the 12/20/24 five percent correction low at 5866.00.

As long as any forthcoming weakness is contained above 5595, ES has confirmed its upside reversal from last Thursday's (1/02/24) low at 5874.75-- now a Double Bottom Corrective Low off of the ATH of 6181.25 (12/06/24), poised for upside continuation to challenge the three-week resistance line that cuts across the price axis in the vicinity of 6060... Last is 6034.25...

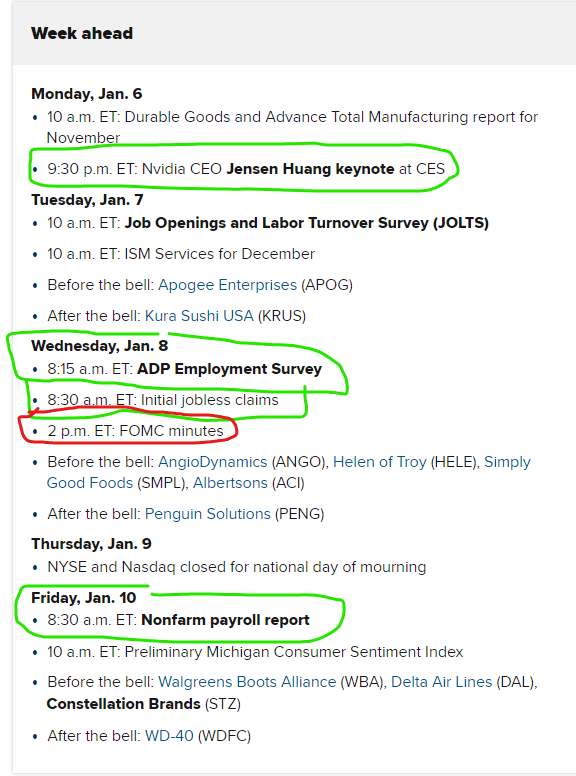

Next Up: NVDA update ahead of CEO Jensen Huang's CES Keynote Address this evening at 9:30 PM ET (See Event Calendar below)...