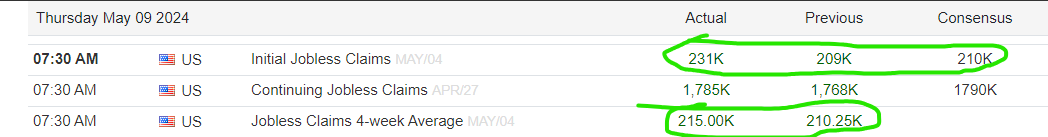

Market Buoyant In Reaction To Jobless Data

Well, well, well, Weekly Claims for Unemployment Insurance INCREASED meaningfully and adds some cache to last week's cooler-than-expected Non-farm Payrolls, the combination of which certainly adds fuel to the fire of those who think the Fed will have justification for CUTTING RATES sooner than later during the second half of 2024...

In reaction to the data, ES popped from 5204.50 to 5215 as the index attempts to thrust to the upside out of the two-day high-level bullish digestion pattern shown on my attached Hourly Chart. ES needs to take out 5217.25 to gain more upside traction needed to enter a new upleg... Last is 5213.50