Is a Perfectly Bullish Storm Stirring for Equity Indices Into Year-end?

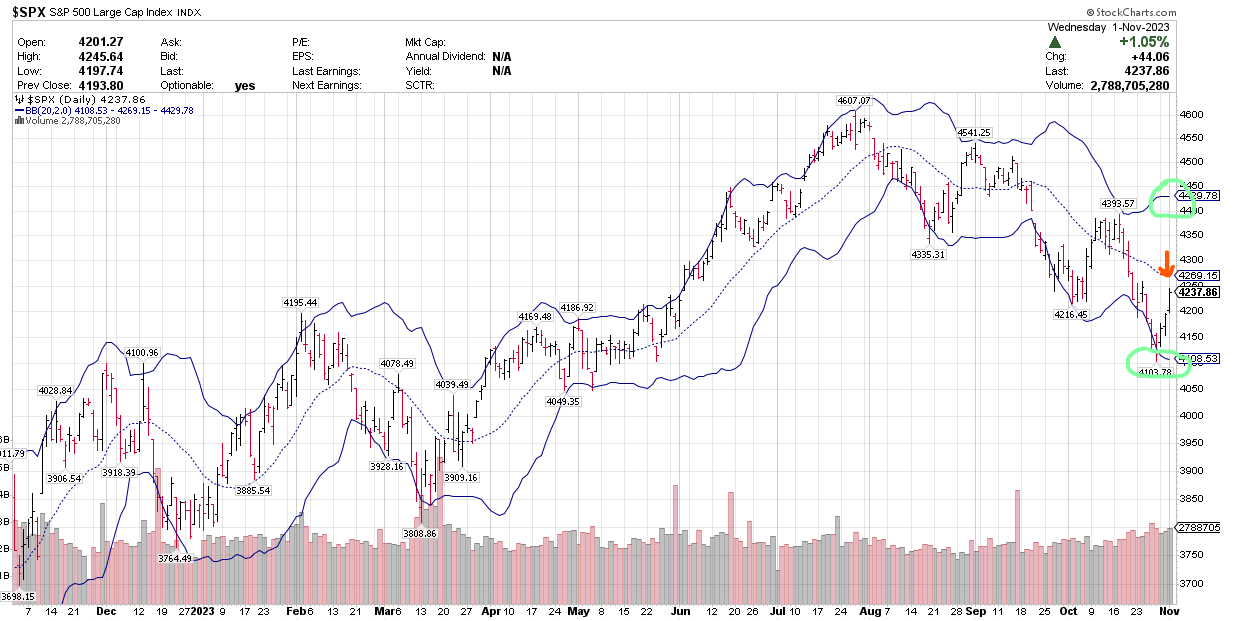

From a Big Picture perspective of the Cash SPX, let's watch price behavior around two MAs in particular-- the 200 DMA, now at 4244 (see lower chart) and the 20 DMA, now at 4269 (see upper chart). A sustained climb above the 200 DMA will argue strongly for upside continuation to challenge the 20 DMA, and if that is taken out on a closing bass (4269), the likelihood of upside continuation to a rendezvous with the upper BBnd Line, now at 4430 increases significantly.

Bottom Line: A close above 4269 today magnetizes the 4430 target level...

In that ES (SPX Dec futures contract) is up nearly 40 points at the moment, SPX will open considerably higher (based on current ES prices) in the vicinity of 4275, positioning the Cash SPX well above its 200 DMA (4244) and also above the 20 DMA (4269).

Of course, the opening bell is 6-1/2 hours from the closing bell and lots can and will happen in between, especially atop a 4% upmove since Monday morning's new three-month corrective low and ahead of tomorrow's consequential Jobs Report. Nonetheless, the blast-off to the upside has the right look of the start of a larger advance that needs to be overlaid on a very positive November monthly seasonal and the growing likelihood of a broadening tape FOMO rally into year-end... As I queried in my earlier post, is a Perfectly Bullish Storm stirring for the equity indices into year-end?