Eyeing Correction In Yield, Upside In TLT

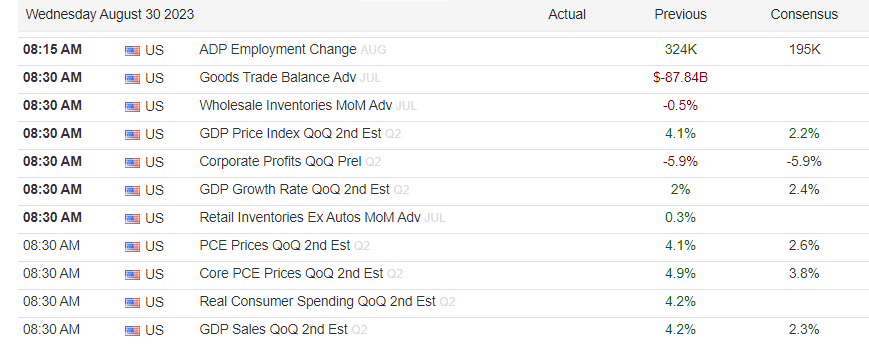

Good Wednesday Morning, MPTraders! August 30, 2023-- Pre-Market Update: T-minus two trading days remaining in the month of August... Another round of potentially consequential Economic Data this morning: ADP Payrolls at 8:15 AM ET.... GDP Q2, 2023 Second Estimate at 8:30 AM ET... Notable Earnings after the close: CRWD and CRM...

The next three sessions will be peppered with very important economic data on jobs, employment, and prices, which could have a significant impact on directional price action in equity and bonds, largely because the data will impact investor and trader perceptions of the likelihood that the Fed has completed its near 18-month rate hike and "normalization" cycle from 0% to 5.50%.

My attached Charts of 10 Year YIELD and the TLT (20+ Year T-bond ETF) both argue that the April-August directional moves in YIELD on the upside and TLT on the downside are complete and that both trends are experiencing a correction (down in YIELD, up in TLT).

With the foregoing in mind, let's watch the TLT closely today, with an eye toward identifying an opportunity on the long side today that has shelf life through Friday AM's August Employment Report... More after the ADP data...