Charts on ES, TLT & NVDA Ahead of CPI Release

Good Wednesday Morning, MPTraders! September 11, 2024-- Pre-Market Update: Today is seared in our memories. We know exactly where we were, what we were doing, and who we were with on the morning of 9/11/2001. Prayers go out to the families impacted in the many ways that tragic day unfolded...

On to the markets...

With the debate behind us (does anyone have a stronger sense of the policy prescriptions of either of these candidates this morning?), we can refocus on the real story, and the real power broker in D.C.: The next move by the Federal Reserve, presumably one week from today (9/18/24) when The Street expects a rate cut of 25 or 50 bps.

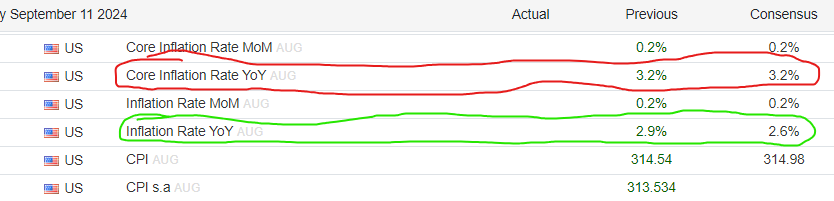

August CPI data will be released in 10 minutes or so. The majority of estimates show continued disinflation toward the Fed's target of 2% (see table below)...

As for the markets, heading into the data, ES continues to exhibit an incomplete counter-trend rally setup (see my attached Hourly Chart). As long as any forthcoming weakness is contained above 5448/50, my preferred scenario argues for upside continuation above yest's late high at 5506 toward two optimal objectives at 5530/38 and/or 5560/70, which represent the resistance/reversal windows for the recovery rally that started last Friday (9/06/24) at 5394.

TLT (20+ year T-bond ETF) heads into the data at 14 month highs (101.41), poised for additional gains into the 102-103 next immediate target window as 10-year YIELD presses lower, beneath 3.60% (3.65% last)...

After the reaction to the CPI report, traders and investors will refocus on NVDA CEO Jensen Huang's remarks at the GS Technology Conference, listening for updated information on chip demand, capex spend, and the ability of NVDA to satisfy demand for Blackwell in the weeks ahead. In pre-market trading, NVDA is poised to again challenge key nearest-term resistance at 109-110 (see my attached 4-Hour Chart), which if (when?) taken out, will trigger a near-term upside projection to 117-121... Last is 108.47...

More after the data are released...