A Look At The Eurozone

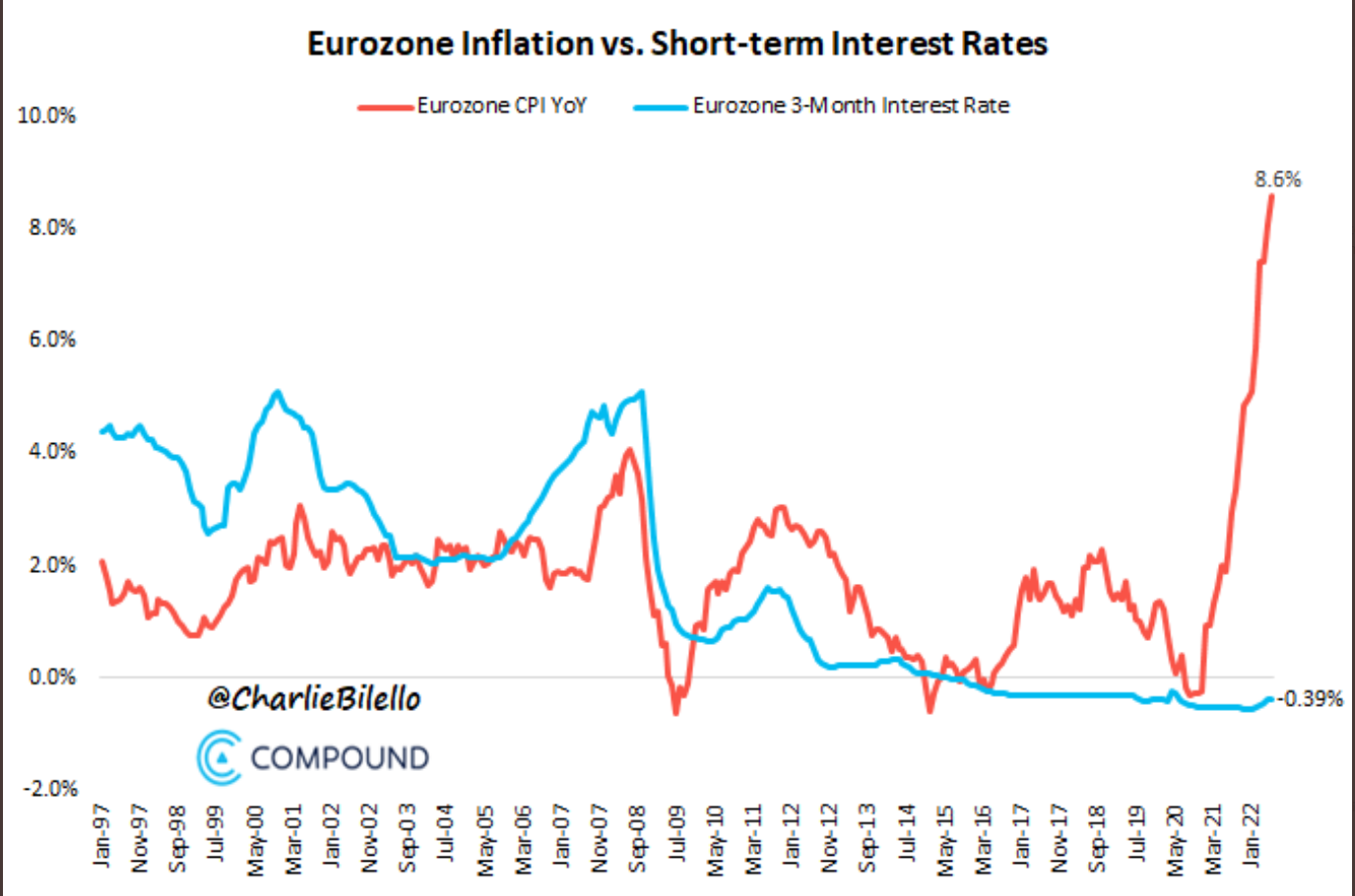

A Look at the Eurozone: First have a look at my attached Weekly Chart of EURUSD, which made another new multi-DECADE low today, then take a look at the Eurozone inflation graphic below courtesy of Charlie Bilello, who attaches the following comment:

Eurozone inflation has moved up to 8.6%, its highest level ever. Meanwhile, the ECB is still holding interest rates at negative levels. This is perhaps the greatest disconnect between easy monetary policy and unabating rising prices that the world has ever seen...

and Finally, have a look at my attached Daily Chart of EWG (German Country Fund ETF) because Germany is considered "the powerhouse" economy of Europe"...

Bottom Line: Euro currency, Euro interest rates (ECB policy), and German Equities all have been, and all remain under intense investor pressure (aka, long liquidation), and likely will require a sea change in the perception of the depreciation of the Euro prior to any meaningful upside reversal.

If a directional reversal in the Euro occurs "naturally," EITHER via a shift to stricter monetary policy by the ECB to combat inflationary pressures, OR via a shift by the Federal Reserve to a slightly less hawkish monetary posture, then owning EWG somewhere in the vicinity of 21.60 (key Fibonacci support), looking for a period of basing and accumulation ahead of a sustainable recovery rally period... should be considered in the days ahead.

Conversely, if the Euro continues to fall in the absence of any meaningful shift in ECB or Fed monetary policy prescriptions, then we should be mindful of a potential confrontation between the ECB and speculative EURO shorts to intervene (possibly with the help of the Federal Reserve) to stabilize a Euro under assault. Such a confrontation will be chaotic for the financial markets, but appropo for the times in which investors currently find themselves... MJP